Lowering Your or a Client’s Property Tax!

Also Is A Highly Rewarding Residential, Commercial, Industrial Property Tax Consulting Business

In A Multi-Trillion Dollar Industry

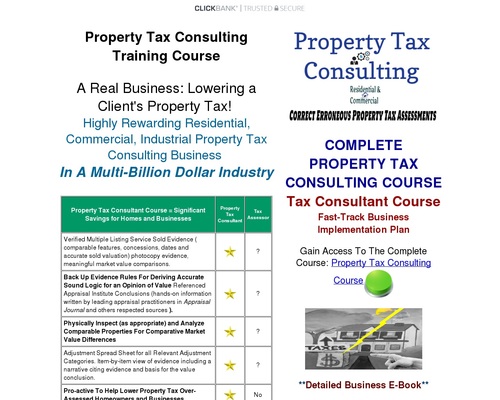

Property Tax Consultant Course = Significant Savings for Homes and Businesses |

Property Tax Consultant |

Tax Assessor |

|---|---|---|

| Verified Multiple Listing Service Sold Evidence ( comparable features, concessions, dates and accurate sold valuation) photocopy evidence, meaningful market value comparisons. |

|

? |

| Back Up Evidence Rules For Deriving Accurate Sound Logic for an Opinion of Value Referenced Appraisal Institute Conclusions (hands-on information written by leading appraisal practitioners in Appraisal Journal and others respected sources ). |

|

? |

| Physically Inspect (as appropriate) and Analyze Comparable Properties For Comparative Market Value Differences |

|

? |

| Adjustment Spread Sheet for all Relevant Adjustment Categories. Item-by-item view of evidence including a narrative citing evidence and basis for the value conclusion. |

|

? |

| Pro-active To Help Lower Property Tax Over-Assessed Homeowners and Businesses |

|

No |

|

Scorecard |

5 STARS |

(Click Here)  Access

Access

Real Estate Appraisal and Property Tax Consultant Residential & Commercial Courses

Using Correct Real Estate Market Valuation for residential and commercial businesses need to correct egregious over-assessed properties and tax overpayments due to

faulty municipal assessments.

Why such large

over-assessment errors? An accurate market valuation home appraisal costs

$300 to $450. Municipalities lack the

funding to conduct expensive blanket reassessments for their territories.

The time spent per assessment is minimal. Very often previous assessments

are simply rolled over. Because everyone needs help, use our 5 step

process for presenting an accurate market valuation for your or a clients

home.

Help others not to over-pay, just pay the proper property tax assessment that they should be charged. Your future clients are being squeezed enough, they should NOT overpay! Experts tell us that over-assessed properties excesses range from 40% to 60% (click underlined for verification).

You will be able to give near-certainty guidance to clients in order to pay exactly what they should be charged, NOT OVER-PAY!

It’s step-by-step and you are encouraged to take on cases from the very beginning so you’ll earn as you apply those specific adjustments to a particular client.

With easy to understand training, you will be able to help clients lower their tax and set their record straight. In the process of helping the client, you earn sizable commissions. Good news:clients are easy to find!

Homeowner’s (and businesses) when they get their tax bill are often taken back by the amount charged! The fact is: Most DON’T KNOW that they are over-charged!

The over-assessed desperately need a Property Tax Assessment Review Service that has their back!

It helps customers who have a tax-reduction case shave-off serious amount of money off their tax bill. Any client who is suspicious of their property tax welcomes your help.

If the property is over-assessed, your property tax reduction procedures help bring about deserved tax breaks that are placed back into the account of that customer. You emerge the hero and earn an professionals income as a reward.

Evaluate the Residential and Commercial Property Tax Reduction Business and Earn Fees with Your First Client

A growing numbers of homeowners and businesses will doubt the accuracy of their assessments and desire to appeal their property taxes!

Again, competition is virtually nil; there are more potential customers than you could possibly handle. You earn a high contingency fee as a result of winning. You get to help a potential homeowner or business reducing his/hers/their property tax.

Rectify a tax injustice and give the customer the property tax break they deserve. In turn, you are rewarded out of that tax reduction by way of a contingency fee that can carry over into subsequent years. Besides feeling great about helping others, this is highly lucrative.

This contingency carryover means you’re rewarded multiple times for the same hours of work. Besides getting rewarded monetarily, you will enjoy helping your client out of an unfair assessment jam. Check out the process!

Package #1

(included in course)

Pre-written, ready to use

PRESENTATION FORMAT for every property tax appeal (a $19 Value)

Extremely Useful Free house appraisal and property tax appeal forms. The forms are PDF downloadable and provide a generic template to organize your information in an acceptable format so you can present your evidence in good style. It is similar to that used by licensed real estate appraisers. You’ll be given the password to access this information shortly after your order.

Package #2

(included in course)

Pre-written, ready to use

All the pre-written forms, letters, customer contracts you’ll

ever need to do business ($599 + Value)

Invaluable Sample Fee Agreement Forms, Fill In Fee Agreement Form, Sample Advisor/Agency Authorization Form, Fill In Advisor/Agency Authorization Forms, Residential Solicitation Letters, Signed Contract Transmittal Letters, Thank You For Choosing Our Company Letters,

Limited Power of Attorney Form, We Have Filed Your Appeal Letters, Invoice Form For Services Rendered, Enclosed Is Your Invoice Letters, Past Due Notice Letters ….

Package #3

(included in course)

Pre-written, ready to use

Property Tax Consultant Insiders Marketing Plan ($500 + Value)

Invaluable This is the ins and outs for making this business work. All the methods, advice and tactics you’ll need to fast-track this business. You learn how to set up your business and learn how to go about marketing your business to a huge population of potential clients.

Package #4

(included in course)

Pre-written, ready to use

Updates for life ($297 + Value)

Invaluable Keep yourself updated with the latest research and property tax appeal advice for life.

Package #5 (included in course)

Pre-written, ready to use

Persuasion Tactics & Persuasive Salescopy Ebook 110 Pages …

($157 + Value)

Useful You can get your hands on all of this value, the product itself, the guarantee that you’ll be ecstatic with the result, and my personal assurance of help with your business if you need it, plus if things don’t work out, the risk is all mine. How much are we talking here?

Not $500, not $300, not even $200, but included with our product, you can get your hands on the whole package. Just think what having the same insider info and expertise could do for you. (click business tactics, persuasive for more detailed information)

Package #6

(included in course)

Pre-written, ready to use

Persuasion Sales Letters & Copywriting Course 136 Pages … ($97 + Value)

Useful The Power Of Words Can Make You Rich. If you can’t persuade people to buy your products, you’re going nowhere. Ever think that maybe that missing piece is knowing how to write persuasive copy to your customers? Could the only thing standing between you and a much larger success be just good marketing copy? (click business sales letters and copy writing for more detailed information)

Gain Unlimited Clients – Earn Unlimited Fees!

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Consultant Residential & Commercial Courses

Fast-Track Business Implementation Plan

Gain Access To Complete Courses for

Real Estate Appraisal For Residential & Commercial Property Tax Appeal: Property Tax Consulting Course

**Detailed Business E-Book**

Free Real Estate Appraisal & Property Tax Consultant eBook Business Overview Guide

Click Upper Left Box To Access

Click Upper Left Learn More For Free

Access

It’s good to keep friendly relations with the tax assessor since one can

re-appeal their case as often as is necessary with new evidence any time

during the year and win. That case can be a residential or commercial

property tax appeal.

HELPING OVER-ASSESSED VICTIMS

Prepare for those months. EXTREMELY PROFITABLE since few if any property tax consultant specialists likely work within your zip code.

COMPLETE PROPERTY TAX CONSULTING COURSE

Tax Consultant Course a Fast-Track Business Implementation Plan

Gain Access To The Complete Course: Property Tax Consulting Course

.png)

100% beginner friendly – no tech skills or experience needed.

Bank 4 figures in contingency commissions per appeal even if you’ve NEVER made a dime consulting.

The easiest & FASTEST way to earn contingency commissions helping the over-assessed.

EARN as you learn property tax appeal consulting.

Set your own contingency fees.

Get Full-Access to a foolproof turnkey system on how to Successfully Appeal Property Taxes and cash into the money almost every single time you take on a client.

Taking the Property Tax Consultant Business Course will help you learn how to dominate an industry With Little to No Competition.

Discover how to earn large contingency fees, even one-time equalization processing fees from prospects and get Multi-Referrals.

Earning LARGE FINANCIAL REWARDS learning as you go by a step-by-step process & building a Property Tax Review Business.

Earning likely a few thousand dollars on each prospect by simply engaging on their behalf in a property tax appeal.

-

Remarkable earning potential

-

Full or part-time business opportunity

-

Superior marketing material

-

Unlimited & highly targeted leads easy to obtain

-

No specific industry experience necessary

-

Nationwide opportunities

Customer Reviews:

I graducated with a degree in Real Estate (Eastern Michigan University) and this course was a great Real Estate Appraisal course, better than in College.

Thanks. Paul S

Purchased your Property Tax Consultant course last year and just as you predicted we are well in our way to a healthy six figure income. My partner and I created a CRM application (JASO)- to process our pipeline in a seamless fashion (from client intake to productivity analysis) – this databases has been key to us in touching base with our customers on a timely manner as well as organizing every facet of our business – we see the value that JASO has been for us and recognize how valuable this could be for other Property Tax Consultants alike.

Currently the application is tailored for Florida however we are updating and customizing the CRM application to be relevant nationwide. We would love to market our product to your distribution list; if we could speak more in depth on the topic, I believe we can come to an understanding that is worthwhile for all parties involved, I look forward to hearing from you soon. Have a wonderful day and a pleasant weekend.

Sincerely, Michelle M

I feel like you are providing a valuable service to homeowners across America. Assessors all over the country raised property taxes in the boom years and are now loathe to reduce them. Every thinking homeowner should look closely at their taxes, apathy can cost them allot of money.

Pat F

Gilbert Az

![]() People reluctantly shell out over $1,000’s of dollars for attorneys and professional property tax appraisers to represent them in order to appeal their property tax with no guarantee of success or winning. A property tax consultant is a life saver! It costs the client almost nothing to assess their options.

People reluctantly shell out over $1,000’s of dollars for attorneys and professional property tax appraisers to represent them in order to appeal their property tax with no guarantee of success or winning. A property tax consultant is a life saver! It costs the client almost nothing to assess their options.

Fees are charged on a contingency basis, which means, if you lose the case, the client risks nothing. Since there is no risk to the client or homeowner, they want your service. Finding potential clients is mind-blowing simple. Some charge an up-front consultation fee. Many do.

Basically, the real estate appraisal system is rife with errors. Valuations are constantly in flux and the tax assessors office rarely does personal valuation visits. They leave it to other blanket assessor services. This is just the tip of the iceberg and it opens the door for a business opportunity that really helps others in a meaningful way.

When a valuation for an jurisdiction is required, the town sets out on a public bid and generally the lowest bidding property valuation broker wins. You can bet your bottom dollar that the broker who won the bid needs to make a profit.

Little time and money is allocated on a per unit basis for the appraisal. Sometimes a raw crew is doing the work. There are time restraints on his crew in order for the mass evaluations broker to earn his profit. Errors are rampant. Therefore a dire need for appealing over-assessment errors.

Helping homeowners as well as commercial accounts lower their property tax is a legitimate business that generates financial rewards.

In this day and age, those who can use some extra income can work this service as a work-from-home based business or an add on part-time business.

Since there is no free lunch, it can be worked in conjunction with another income stream such as the mortgage brokerage trade, real estate, insurance and similar consulting industries. It can be worked during slow times or just to do something challenging and different to help turn the table by helping correct regulatory errors.

Residential Property Tax Appeal School

Residential Property Tax Appeal School

Residential property tax appeal opportunities abound. You’ll find you’ll never run short of finding bad assessments to correct not to mention those referrals looking to reduce their property tax over assessment.

Expert studies indicate that the percentage of assessment error exist is high. It’s clear as a bell that you’ll never lack clients.

As long as property taxes are levied and that real estate market valuations fluctuate, you’ll find an over-abundance of cases where the assessment valuation against a homeowner is flat out wrong. Championing that tax appeal is an opportunity to be of great service.

The bigger the tax bill, the greater the reward.

Commercial Property Tax Assessment Training

Commercial Property Tax Assessment Training

The commercial side of the business deals with larger properties and, needless to say, larger commissions. Commercial valuations are based on an Income Approach. If they earn less net income than the previous year, their property tax assessment should be less. You’ll learn about the opportunities that exist in this area of specialization.

Strip malls lacking tenants may need to appeal an old assessment. Apartment house and complexes vacancies, many small to medium businesses that might be suffering could file appeals when the facts warrant. Again, a business valuation is based not on a Market Value Approach but on an Income Approach.

Fact is, unlike residential properties which use a comparable property approach, a commercial property valuation is made on an income basis. And guess what? If cash flow to the commercial property is lacking business or tenants, you might have found a client who could use significant savings!

Give others the tax break they deserve. Provide a service where practitioners are scarce and the results are valuable.

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Consultant Residential & Commercial Courses

Fast-Track Business Implementation Plan

Gain Access To The Complete Courses for Residential & Commercial Property Tax Appeal:

Property Tax Consulting Course

Your first Guarantee: You have TWO full months to examine everything, use what you wish, and, if for any reason or even no reason, you want a full refund, just return everything and you’ll get your money back immediately. NO questions asked. You do not need a ‘my dog ate my homework story’. No one will ask you any questions at all. No hassle. No ‘fine print’. Simple and straightforward; you are thrilled with what you get or you get a full refund. I’m devoted to the goal of only having satisfied customers. If you’re not going to profit from having my System, I really would prefer to buy it back.

My sole purpose in offering this course is for bringing social justice to those over-assessed. To correct wrongs. Many tax assessors view their job as preserving the tax base and are not pro-active in helping over-assessed victims. The fact is that over-assessment errors are excessive and need to be addressed. Assessment bureaucrats need to be shown the facts and if they turn a blind eye, there are two more avenues of appeal: The Municipal Appeal and the State Appeal. We need activists who will stand up against the bureaucrats and with the right evidence, you will win.

I want you to put hundreds of thousands of dollars into your bank account in the course of the next ten or twenty years with this professional Property Tax Consulting Home Consulting Course.

LEGAL: While it has been proven by many of our customers that you can generate income very quickly with this information,

please understand that what you are buying is in fact INFORMATION and not a promise of riches or financial gain.

What you do with this information is up to you.

Leave a Reply